By Gideon Malherbe

VCI Founding Partner

A novel idea to design a winning strategy is to ensure the company’s positioning and revenue streams are broadly in line with where smart money and big capital are grazing. Doing Scenario Planning certainly helps to surface the opportunities that under normal circumstances are being washed away in the flood of daily media noise.

Multi-generational private companies can afford to look at the shaping forces including the capital migration with a 10-year-plus view. The advantage is that they can optimize their value creating whilst adapting their business model. Many public company CEOs cannot do this as their earnings calls and daily pressures compel them to take a shorter-term view. CEO tenure in public companies is at a historically low of 4.5 years.

The leading question is: “How does one reconcile the need for immediate results with the advantages of long-term positioning?

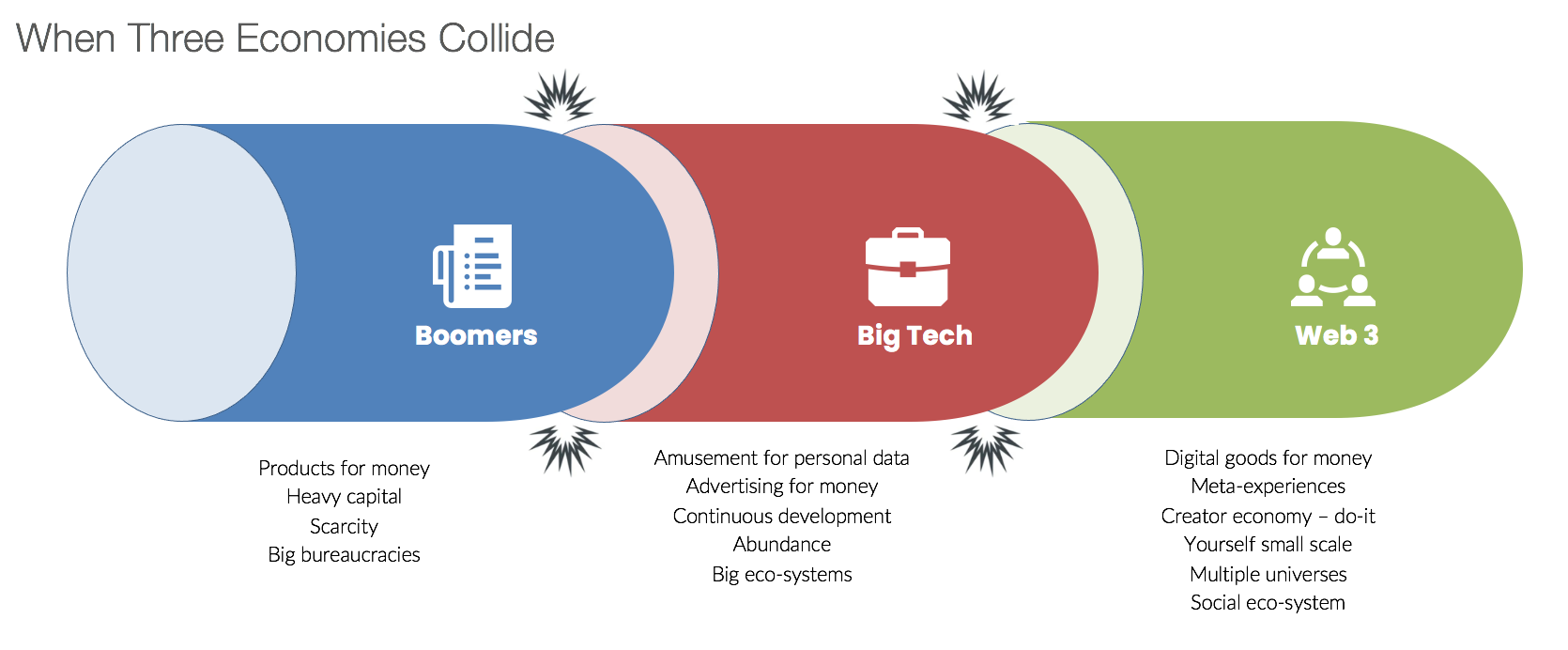

Just knowing the basic constructs of the three co-existing economic constructs is insightful, but not useful in developing your strategic plan. The Boomer economy is characterized by supply and demand dynamics, cost of capital and economies of scale, and are well traded as people at least fundamentally understand how it all fits together. It also offers some predictive ability. The newer big-tech structures underpinned by platforms are less understood as they dis-intermediate the Boomer sector with a juxtaposition of mega-scale size and near-zero marginal costs. This is all thanks to technology and artificial intelligence developments. They also represent the stinky basement activity of exploiting private information for advertising revenue.

Web3, including NFTs, DAOs, blockchain and crypto are even less understood, hyping a vision of creating multiple synthetic universes each with its own “unique” experience. Easily understood as simply computer games monetized to the hilt whilst being pulled from 2D to 3D viewing with new AI bots. Daily new start-ups offer more experiential dimensions, each with its own financialized tricks and tools in search of broader utility. This sector includes further decentralization of businesses with a targeted deeper penetration into the people identified as un-bankable, young, and previously not included in mainstream economy.

It is quite revealing to reflect on how each of these economies adds revenue and creates value. We are compelled to play with well-worn economic tools; companies offer things (products and services) that are better/easier and cheaper than their predecessors. Then there are the ego-affirming or differentiation plays as well. I would argue that they are also held hostage by the longer-term, invisible free hand that steers all products and services to commodify.

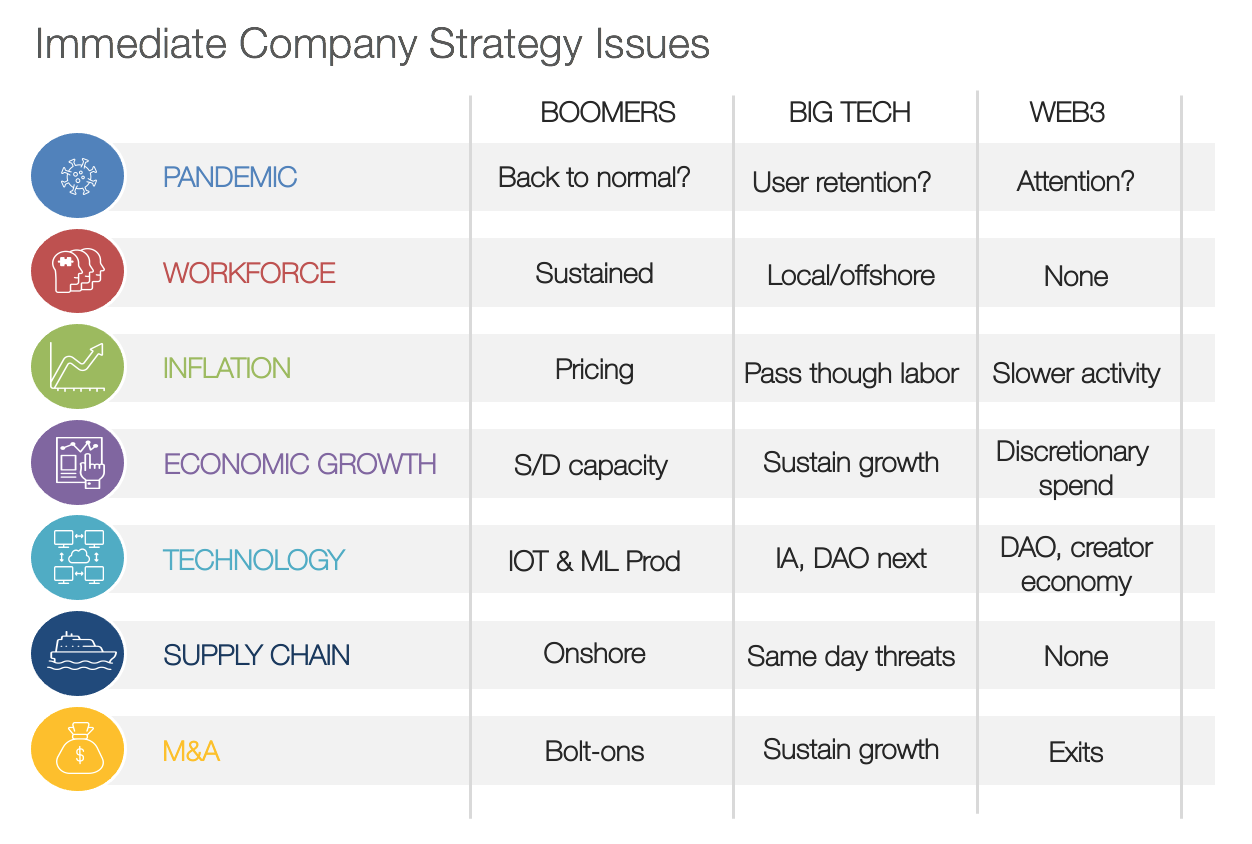

The analysis of how each of the three economies work, and how a company should strategize to maximize value, is unfortunately derailed by the urgencies of the day. It is to this end that we base the strategic discussion from a more immediate perspective.

The more immediate strategic planning topics are necessary because that is what the market wants to hear about. And with only a few years tenure, it’s necessary to maximize value in each of these immediate issues.

The natural bias for decision-makers is to simply stay in their respective swim-lanes and work down the check list to see if all matters are properly attended to. The real strategic work is different. It wants the decision-makers to breach the swim lanes and ask what can be done in the adjacent swim lanes to capture increased value.

For example, a Boomer company is paralyzed by employment shortages. An adjacent solution may be to outsource, let’s say, all technical maintenance work, thereby concentrating work with a company that can more efficiently deploy its workforce over multiple customer sites. More opportunistically, decision-makers can analyze and understand the revenue models of the other economies, and shift some company activities into another model – like Amazon stepping “backwards” into Whole Foods. We can expect to find both Amazon and Whole foods issuing NFT’s and having Web3 digital storefronts pretty soon.

The insight here is to encourage your decision-making team to think outside the industry swim-lanes, and regardless of what economic sector you represent, Boomer, Big Tech or Web3, there are revenue and cost opportunities by jumping a few lanes.

We use Scenario Planning to play out multiple futures that promise the best set of strategic options for a company to grow.

KEY TAKAWAYS:

- How does one reconcile the need for immediate results with the advantages of long-term planning?

- Technology and AI are dis-intermediating the Boomer sector of the economy

- The multi-verse promises multiple ‘unique’ experiences, each with its own financialized tools

- Decision makers must think outside of their swim lanes to discover new revenue opportunities

- Scenario Planning helps surface opportunities that are ordinarily drowned out by low-effort media content

Your participation enriches the conversation.

Click HERE to download this white paper

We are actively helping companies with their Scenario Planning so please feel free to reach out.

Gideon Malherbe is Founding Partner of Virtual Consulting (VCI) and well known for his development and implementation of unique methodologies and strategic insights that deliver truly extraordinary results for clients. As visionary of VCI, Gideon has orchestrated strategic positioning projects for clients worldwide. Over the past 20 years, he has helped hundreds of CEOs with their Scenario Planning projects.

Virtual Consulting USA, Inc.

New York, New York

+1 914-381-0000

gideon@virtualconsulting.com

February 2022 © Virtual Consulting USA, Inc.