By Gideon Malherbe, Chief Strategist

By Gideon Malherbe, Chief Strategist

Rabble-rousers are having much fun these days by extrapolating current events beyond reasonable logic, which gets clicks and lots of discussions, even amongst leaders in charge of company strategy. The Ukrainian war and subsequent US financial sanctions against Russia are good examples. Then weave in inflation, interest rates, and the banking crises, including the role of crypto assets in the cases of Silvergate Bank and Signature bank.

Of course, these discussions are all inside a grand narrative of an imminent economic recession or depression forecast by many for the U.S. in 2023. How are executives to think about this barrage of negative inputs? Let’s walk through the narrative of de-dollarization of the world and the rise of the Renminbi. The loss of being the global reserve currency will lessen the demand for the U.S. dollar and potentially cause its value to decline in foreign-exchange markets as well as reversing some of the advantages its dominance has conferred on U.S. institutions and investors.

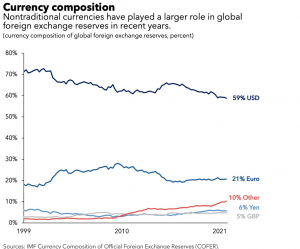

This discussion is popular not only because of China’s deliberate efforts to have countries (Russia, India, and many developing countries) settle their trades in Renminbi rather than U.S. Dollars, but also because trend lines of foreign exchange reserves would seem to support that the U.S. Dollar has indeed declined from about 70% in 1999 to 59% in 2022.

The weakness in the argument is the lazy belief that all things will remain equal. Here, Scenarios help us to think more clearly. The driving force behind the decline over the last few decades has probably more to do with the growth of globalization rather than the current U.S. financial sanctions against Russia, which is used as the popular key driver for future decline.

Here are four possible future Scenarios:

Scenario 1: Continuous decline of U.S. Dollar as a global reserve currency.

The forces supporting this view are that Japan, China, and the EU continue to grow and expand their footprints economically.

Scenario 2: Current ratios remain largely like what we observed in 2022 – 2023 (i.e., the U.S. Dollar will remain in the 55% – 65% range of global reserves).

Forces supporting this forecast are that the EU settles broadly in its current economic trends, the Russian sanctions stay in place for several more years, but that China’s growth weakens (also a known probability).

Scenario 3: The U.S. regains a growing percentage of the global foreign reserve basket.

Forces leading to this future include a weakening economy in China plus significant economic failures in the “challenger” currencies’ economies. Here the U.S.$ becomes the best of a set of bad choices.

Scenario 4: The Renminbi rapidly rises to become a legitimate contender as a global reserve currency.

Forces that support this future are a failing of the U.S. in fixing its synthetic debt ceiling debate, the U.S. economy falls into depression with the EU rapidly following suit. In this scenario, the China somehow manages to sustain its own economy and vigilantly capitalize on the failures of the U.S.

So, we end up with different sets of beliefs for each Scenario, none exactly right or wrong, and all nonpredictable. But each view changes the narrative. Let’s walk through some strategic conclusions.

Volatility and uncertainty provide gaps for interlopers to upset the current system. So, there is a possibility that the U.S. Dollar may lose its role as a global reserve if volatility and uncertainty increase. What do you think?

Then trust plays a major role in the world’s financial construct and perhaps the U.S. is not the pinnacle of trustworthiness. But if not, then who?

Finally, look at the actual financial eco-system and governance. I think it’s bad for the U.S. to weaponize its financial system, like with blocking Russia from the SWIFT system, but the ability of contenders to do much worse if they so wish, especially in a highly centralized, politically driven system should make one wonder. The complexity and vastness of the international financial system may be its strength after all.

Scenario Planning does not involve making actual predictions. So, the instinct to place probabilities on the Scenarios should be avoided.

In the obligation to make viable long-term plans, Executive Teams can develop and apply Scenarios to seek opportunities, hedge against potential risks, and improve the robustness of specific strategies.

We have a unique and successful method for Scenario Planning that has been perfected over 30 years of specializing in this field. Let’s discuss how Scenario Planning can work for you.

Download this edition of Executive Insights June 2023

Call or text 1 914-381-0000

gideon.malherbe@virtualconsulting.com