First Scenarios, Then Strategy

By Gideon Malherbe, VCI Founding Partner

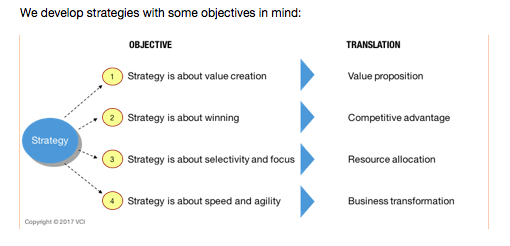

Strategic Planning can be less effective because of subtle and nuanced biases in the foundation data and false beliefs in the executives’ own personal world views. Start with these Scenario considerations BEFORE you craft your strategy and improve the positive impact to your business.

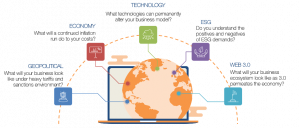

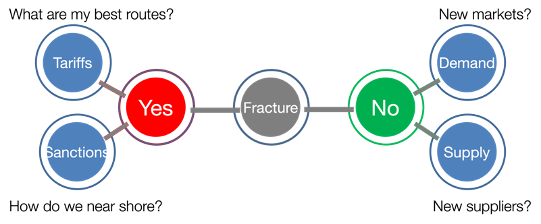

1-Geopolitical

Will the Russian- Ukrainian war lead to a more fractured global economy?

Scenarios will lead management to think about both worst-case outcomes in which alternative trade routes and near-shoring are principle decisions. If the Scenario plays out that global trade will continue pretty much along the same pathway, then new growth opportunities should be investigated.

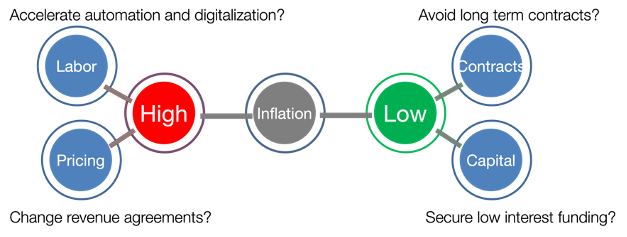

2-Economy

Will high inflation continue over the longer term or is it a short-term anomaly?

Using inflation as an example, under ‘Economic Scenarios’ you must have clear strategies for a high inflation future. This includes options for labor cost management and rethinking pricing and contracting options. Under the ‘Normalization Scenario,’ the company must avoid being trapped over the long term with expensive supply agreements and find opportunities to lock in low interest funding.

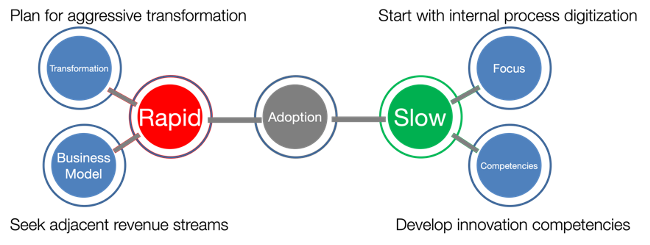

3-Technology

Technology and technology adoption include a vast range of potential discussions, be they digital, blockchain, Web3, Biotech, Space tech etc. Every executive team must determine the technologies that may become game changers in their industry and develop Scenarios to address them. An easy scenario construct is the speed of mass adoption. In other words, asking when the particular technology, say automated trucks, will dominate road transportation.

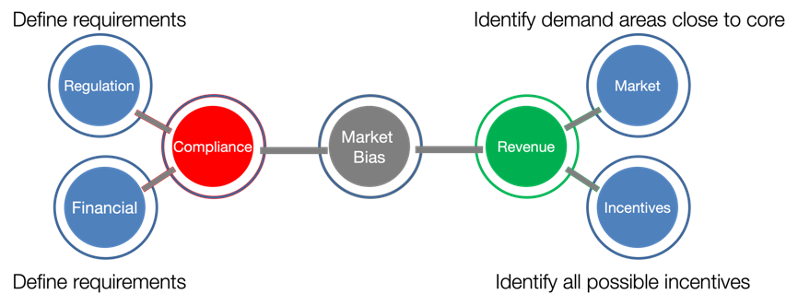

4-ESG (Environment, Social, Governance)

ESG is a strange animal. We begin to define all energy as grey energy to not get trapped in either/or situations. Broadly plotting trends of relevant energies, an executive team can identify various defensive and opportunistic plays for their strategy. Then shift to regulation and clearly define the options – again both opportunistic and defensive strategies should follow.

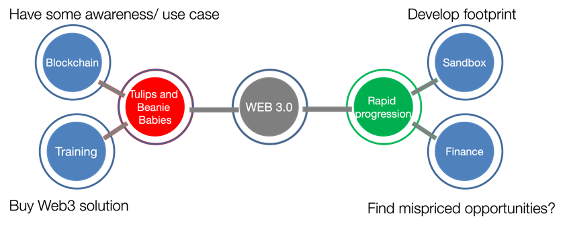

5-Metaverse, Web 3.0 & Blockchain

With US $70 Billion already invested by Meta in this space and a majority of big banks entering, this new digital development must not be ignored. Industrial blockchain is being successfully deployed to record green products and commodities. Automated loan and payment systems play well in the world of gaming and pure digital transactions, especially buying or selling NFT’s.

You can follow the big brands in their deployment plays and find unique and novel entry points for your company. Experimenting with many ideas is probably the best route in this evolving digital world.

Conclusion:

Strategy making is about concentrating company resources to win with certain plays. To attempt to do everything right is to invite bankruptcy. Doing a few things very well will give superior margins. Determining the best few plays is what strategy is all about. Developing proper Scenarios beforehand helps level the playing field lest we become trapped in our own corporate eco-chamber.

Let’s get in touch.

Call or text +1 914-282-2299

gideon.malherbe@virtualconsulting.com