“Every new technology in your strategy will rapidly reduce in its cost and price. In a few years, a brand new electric car will cost you less than $5,000 and probably be built by Dyson.” -Gideon Malherbe

By Gideon Malherbe, VCI Founding Partner

One of the biggest barriers standing in the way of useful Strategic Planning is how easily people get trapped into bad design frameworks.

Why does this matter?

Because creating a reliable and successful Strategic Plan will allow us to better leverage the competencies and assets of the company to achieve an exponential future. Inadequate frameworks for planning will always fall short of realizing robust results.

Our framework for Scenario Planning is a robust component that enables scaling up for much larger ecosystems. And it’s a critical aspect of long-term planning that most methods don’t bother to include.

For example, Scenario simulations are super useful in helping us identify the best clean energy investments or the optimum joint ventures to engage with to establish pathways toward a zero emissions future.

Tracking the latest developments in Scenario Planning is a key focus of our facilitated collaboration and co-development planning programs.

THE CHALLENGE WITH IDENTIFYING OPPORTUNITIES

The power of Scenario Planning comes from its ability to capture novel future world constructs and ideas. But these future states are fragile and can be easily compromised by planners locked into set assumptions to evaluate their options.

An example of this might be designing a scenario set that looks 15 years into the future to identify opportunities, but then applying reference unit costs of production to determine the value of the future option.

The mixing of past references in evaluating future options is not sufficient.

In this type of case, the results introduce a false narrative about what otherwise could have been profound opportunities for the business. You can see this weakness in so many current ESG and sustainability reports of many global corporations.

The trap is that the many obvious opportunities for corporate strategy to pivot or redirect the organization to higher growth and performance in an ESG world is not embraced, simply because the underlying assumptions that drive executive judgement were not unpacked properly.

The standard Scenario Planning process starts with deciding on time frames, the degree of offensive and defensive plays, risk propensity and uncovering the wicked questions that become the axes for storytelling. We use PESTLE (Political, Economic, Social, Technology, Labor, Environment) or a derivative thereof, to categorize the macro forces. Once the external future world is described in four Scenarios, management evaluates their opportunities and threats in those “future worlds.” Here’s the problem, the flaw in the opportunity analyses is that although the scenario stories are futuristic, the analyses to determine the value of these opportunities is not futuristic.

For example: A future scenario describes the power balancing between solar and wind supply and the out-of-sync consumer demand cycles. This unbalanced system is costing the clean energy project significantly. A possible solution may be small scale flywheel equipment that simply consumes surplus power and regenerates it later without chemicals or massive infrastructure. This patented solution is now in venture funding. Because the company evaluates the cost of power and the costs of both generation (Solar and Wind) as well as novel flywheel technology in values calculated from the current references, the opportunity is rejected. However, a second look shows that the cost/benefit of, for example, a solar solution has dropped 400X since 1977 and costs are now 10c/KW or less in the U.S. To apply reference prices to future opportunities misses the essential value of Scenario Planning.

We are comfortable to say that management seems to underestimate the decline of fossil-based demand and overestimate the complexities of new energy deployments, as the core of the discussion.

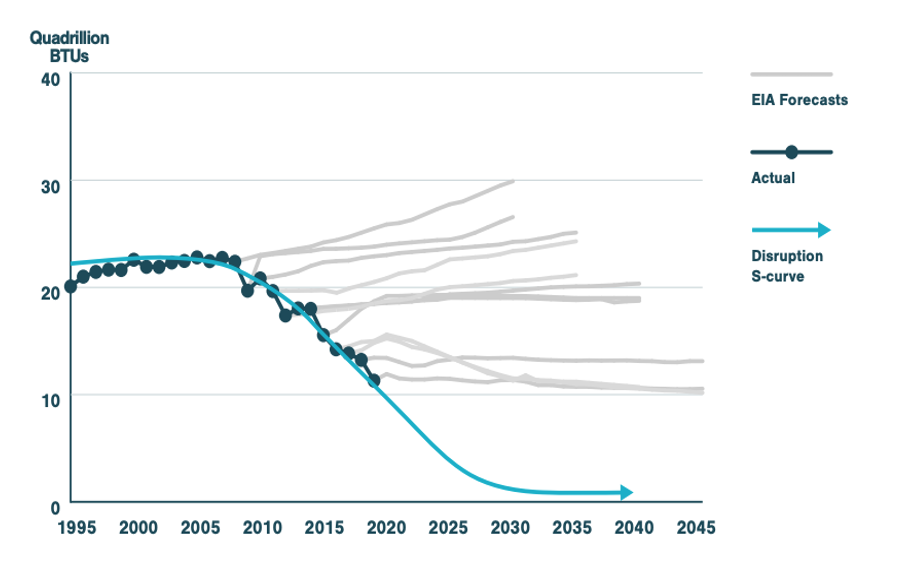

Let’s look at the evidence: Here is the EIA’s forecast for U.S. coal consumption vs. actual.

Source: U.S. EIA Annual Energy Outlook Series, 1995-2020

The sad part of this story is if you look at each year’s new adjusted coal consumption forecast (the grey lines), they remain unmoved by real data as the analysts stick to their traditional models, even though they have been absolutely wrong for 11 years in a row. And we still hear the industry leaders and politicians punt the same institutionalized figures in their publications and at their conventions.

It has been two decades since the concept of paradigms was introduced. We were shown empirical research about how incumbents unwittingly alter reality to retain the entrenched positions (their paradigm). This is of course totally sensible if the incumbents believe they can sustain their privileged position by doing so. And unfortunately, that never happens.

Behind this observation lies a deadly serious insight. Management’s compulsion to find absolute truths, however noble, often culminates in an overconfident and underperforming corporation. I’ll leave it to you to point to whom I’m referring. We are attacking the status quo of strategic plans that messages a sense of fait accompli and confidence in a future that is just not true.

We recognize and are quite horrified by the vast strategic clout these corporations have over the views and beliefs of the many entrepreneurs, small-medium sized business owners and people in their adjacent employment communities. Even over government.

To detect these errors, let’s call them “anchoring flaws” in strategy making, we must discuss each opportunity’s drivers differently. This is hard because these very anchoring flaws comfort management, and their economist will help by “holding everything else constant.” So, instead of looking at the potential opportunities from some known reference point, let’s challenge every anchored assumption. By undoing the current set of assumptions, it’s possible to work out whether the opportunity is a function of a paradigmatic belief or a real option. We then identify the anchoring flaw, and correct it, all without actually breaking the Scenario context. Maybe goats mowing lawns and inner-city high-rise farming are not really so far-fetched.

Implementing these ideas within a corporate planning team is elusive, and this has to do with an understanding that it’s not polar (either everything is predictable or everything that happens is just by chance). The trick is that all industry’s normative reference points should be challenged with potentially future-centric working alternatives. It is the ability to intellectually hold down the many uncertain nodes. The sharing economy for car manufactures is an easy example: Car builders use a normative calculation of per capita income, population growth and cost of fuel to determine the demand for new cars. In an ever-increasing sharing economy, these variables become irrelevant, and a new set of variables come into play, like for example, trust, smart phone intensity and 5G deployment.

We are seemingly trapped to construct the future, given all the mental models so carefully deduced from our history. Yet, we know the future will not represent those past relationships. We must stop creating futures that are simply linear projections into a future made up with all the old causal relationships and a few sci-fi ingredients added.

If our new opportunities in the Scenario set are identified, and the traditional set of variables and relationships are used to test its viability, then a whole set of nonsensical strategies follow. And unfortunately, that is what you will see when reading most corporate ESG and sustainability plans. There are exceptions, and they are the reason for publishing this note.

WHAT MORE REFLECTION SHOWS

The industrial revolution brutally transformed agrarian society to a global industrial machine. It relentlessly discarded many of the then dearly held “universal truths.” Yet, few if anyone at the turn of the 19th century had any idea what they were working with when they discussed their future strategies. A few decades ago, Apple launched a home computer, then a smart phone and again nobody imagined a world where millions of people are on their smart phones for hours every day. Or that 42 gas plants are run remotely (from home) from the very same phone.

Empathetically, you could recall all the failed visions of people attempting to create new utopian societies – religious sects, political ideologies and technological constructs included. Most fail. And yet, we are absolutely the product of those that did not.

Besos and Zukerberg are feverishly trying to reframe society and Musk is driving engineering to an unprecedented level with the vision of tipping earthlings into a multi-planetary species. Google is spending fortunes on developing AI to equal or better human intellectual function.

The world before these new pioneers stepped onto the stage and the world after their impact is not the same. We all know that the rules of business have changed – for example, channel purity where the OEM was differentiated from the value-added distributer that had its unique role in relation to the vendor. That was an economic structure revered in the past as the superior strategy, and is now simply counted as unprofitable. Omni-channel business models now beat the focused players. We can also lift the vail of most industry sectors and discover the increased amount of JV’s, collaborations, and cross investments where boundaries are dissipating and where ecosystems become the fundamental driver for business success. Instead of having a single job, people are increasingly flexing their own skills and by doing so are fragmenting the very assumptions of organizational behavior and values.

WHERE DO WE GO FROM HERE?

In this next iteration of future building, corporations are compelled to take charge of doing what should be done to reframe social, environmental and governance norms. The original Scenarios approach made us go beyond the linear strategic planning boundaries of the past. It endeavored to craft multiple futures and reasonably demonstrated that we can suspend disbelief and resist submitting to our defensive urges to bring things back to a simple mono-chromatic understanding. The challenge now is to extend that mental ability and expand the concept of multiple universes in a fully futuristic world free from the “known truths.”

While we are not there yet, I know Scenario Planning is within touching distance of the threshold where corporate planning exceeds current institutional boundaries, and in doing so, can advance business creation exponentially toward a universally successful business construct.

Scenario Planning requires the courage of entrepreneurs, the intellect of critical thinkers and the true leadership to identify and assemble the future, with its thousands of evolutionary and decaying forces that converge and morph with each other at a different pace and with different impacts on the relative environment.

Futurist research makes it clear that the underlying principles of Scenario Planning are sound; and it has the capacity to properly construct exponentially more significant outcomes by deliberately engaging leadership in the conversation.

If you’re an executive excited about the developments made so far with Scenario Planning, there’s no better time to relaunch your strategic office’s purpose and mission.

JOIN VCI’s SCENARIO PLANNING COMMUNITY

Every year, my team and I work with several CEOs to guide and mentor their leadership teams in our Scenario Planning methodologies.

Our mission is to help client teams master the art and science of Scenario Planning to add material benefits to their companies.

If you want my facilitation as an experienced Scenario Planner to reinforce your team’s efforts, to inspire and guide you to create a positive, compelling, and abundant future for your company, then please reach out and let’s have a discussion.

Let’s get in touch…

+1 914-381-0000

gideon.malherbe@virtualconsulting.com

October 12, 2021

Categories:ESG, ESG Strategy, Scenario Planning, Strategic Planning, VCI, Virtual Consulting, Virtual Consulting USA

0 Likes